Understanding your Council Tax bill

The bill is made up of three main sections.

Billing information

The top section shows the main details of your Council Tax account.

- the Council Tax year the bill covers

- the names of the person or people liable for paying the bill

- the address the bill has been issued to (this is either the address of the property the bill is for, or a contact address)

- the date we issued the bill

- the Council Tax account number

- the address of the property the bill is for

- the property's Council Tax band

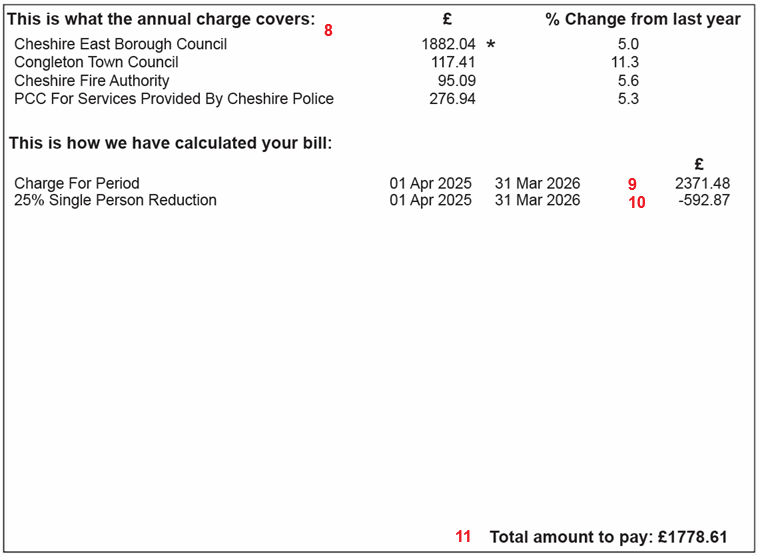

How we work out your bill

Council Tax is made up of charges from Cheshire East Council, Cheshire Fire Authority and Cheshire Police (shown as Police and Crime Commissioner). For information on how we work out how much money we need, see Council Tax budgets.

The Cheshire East Council charge includes a Flood Defence and Coastal Erosion Risk Management Levy collected on behalf of the Environment Agency.

From 2025-26 the Adult Social Care funding will no longer be shown separately on the bill. It is included within the total local authority charge.

If you live in an area where there is a parish or town council, there will also be a further charge for the services they provide. See Council Tax charges 2025-26 (PDF, 105KB).

8. how the annual charge is broken down between Cheshire East Council, your parish or town council, Cheshire Fire Authority and Cheshire Police, and the percentage increase or decrease for the year.

9. total annual charge (before any reduction)

10. reductions you get, for example, single person discount

Reductions will show on your bill as for the whole year even when they are only for a fixed time period. We will send you a new bill when the reduction is coming to an end. If you think you should keep getting the reduction you will need to apply again.

11. total amount you need to pay (after any reduction)

See an example calculation of the 2025-26 annual bill, and comparison to the previous year.

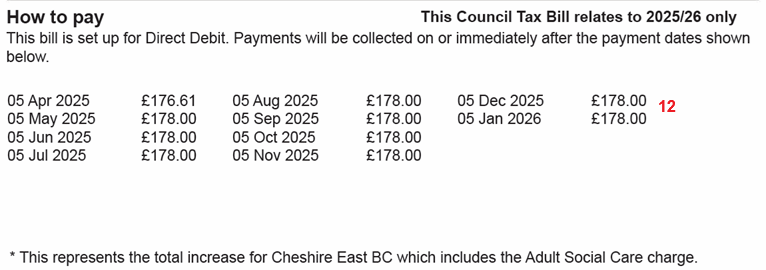

How much to pay and when

This section shows a breakdown of your due payments for your current annual charge. Your ‘yearly charge’ bill does not include any money you may still owe for Council Tax from previous years.

12. the date and amount of each instalment

The back of the bill explains different ways of when and how to pay your bill.

Direct debit is the easiest way to pay and is also the method that costs us less. If you don't already pay by direct debit, it's quick and easy to set up a direct debit online.

If you need your account number and don't have a bill

If you need your Council Tax account number but don't have a copy of your bill, you can find it in your Cheshire East account. You will need to have registered for the Cheshire East account and linked your Council Tax account. Your reference number is listed under 'Your accounts'.

If you do not have a bill or access to your online account, you can contact the Council Tax team to request your reference number.

Council Tax enquiry form

If you're unable to use our forms or have any questions about your bill you can call the Council Tax Customer Service Team on 0300 123 5013 during normal office hours, 8.30am to 5pm Monday to Friday, excluding bank holidays.

Translate this page with Google translate

Open or close Cecilia chat bot

Open or close Cecilia chat bot

Page last reviewed: 06 March 2025

Thank you for your feedback.